Identifying reliable tea suppliers involves time-consuming trial and error. It is risky, costly, and absolutely essential to success in the tea business. Retailers generally rely on wholesalers to do the heavy lifting involved in sourcing but pay a price for the service while suffering a lost opportunity to precisely tailor their offerings to the unique needs and desires of customers. The most successful retailers discover the teas that matter most to their clients and are willing to sacrifice the expedience and efficiency of the supply chain to differentiate their brand.

Will next-generation marketplaces be the answer?

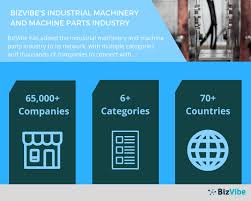

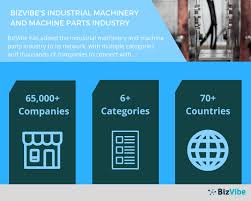

BizVibe is a Toronto-based business-to-business marketplace providing next-generation sourcing software in competition with e-commerce aggregators like China’s Alibaba.

BizVibe recently updated its software with an eye toward assisting tea wholesalers and retailers doing business with China. “As tea production in China reaches new heights in 2017, so does new business opportunities,” according to a company spokesman.

Alibaba, founded in 1999, is now a $25 billion venture. Type the word “tea” into the Alibaba search engine and descriptions with photos of 374,250 products appear. A click puts you in contact with the sales desk. Unlike the same search on Amazon, which returns 1,598,335 consumer-focused results, the teas and quantities on display details helpful to wholesale.

The Alibaba keyword search returns prices with order minimums (listings include details like “100 boxes per case totaling 2,000 packages” or “bulk delivery” of 10–100 kilograms). The site publishes customs data, price quotes, and trade assurance delivery guarantees, and, perhaps most critical, the site provides a company profile with verified data on annual production volume, earnings, business performance, transaction history, and product certifications, along with contact details for key personnel.

“As a global B2B marketplace, BizVibe is perfect for companies that want to simplify the complex and tedious process of product sourcing and supplier selection. Get quotes quicker, generate better leads, and unlock a hidden world of new business opportunities,” according to the company.

Company discovery and selection is free on BizVibe’s B2B networking platform. To learn more, verify the claim above, World Tea News selected a known supplier and gave the online marketplace a try.

BizVibe’s search tools group industries by category: Food & Beverage yields 318,480 results (worldwide). Narrow the search to tea products to get 4,623 returns. Select “China” and the software returns 187 companies. Additional filters screen for annual company revenue and size.

In fact, there are 80 million tea farms in China, and 40,000 registered tea-processing companies principally organized for domestic supply. The number of companies identified by Bizvibe reveals a very thin selection and not only is the number small a closer examination shows very little useful detail. Several thousand Chinese tea companies hold export licenses but only a few hundred major firms export large quantities of tea acceptable for import to the European Union, Japan, and North America. BizVibe notes that the top five importers of Chinese tea are Morocco (15 percent), Hong Kong (11 percent), Vietnam (7.5 percent), the U.S. (6.1 percent), and Senegal (5.3 percent). In theory the companies doing business with these regions would log in to BizVibe and update their company details with specifics essential in making at least a preliminary choice among companies.

I selected Zhejiang Tea Group (ZTG) for a closer look. I know the company well, and have visited the firm’s gardens, toured its factories and dined with the company’s top executives in the U.S. and China. The firm has a U.S. distribution office in New Jersey. Annual sales, according to BizVibe’s BizScore, are in the range $11–100 million. Employees were estimated at 100 to 500.

Publicly held companies are legally required to publish vital details about their business operations. Regulators police this information and auditors, investors, and the stock market analysts severely punish firms that mislead shareholders.

Private companies are much more difficult to research. The real test of discovery on an e-commerce platform is looking at what is available about privately held companies. In this instance, BizVibe returned very little information of value. The category, location of the headquarters offices, and website is correct but annual revenue at ZTG is significantly greater than $100 million. In fact, the company is the world’s largest supplier of green tea. Alibaba noted that in 2005 ZTG ranked 329th among China’s 500 largest importers by volume and ZTG ranked 190th for revenue among the top 200 biggest exporters. ZTG was founded in 1950 and has been selling tea in the U.S. since 1995. The company has grown significantly in the decades since the 2005 Alibaba update, but providing fresh details is voluntary and obviously not a high priority for ZTG.

In practice, companies routinely provide business information to potential customers in much greater detail. If a sale hinges on reassuring a big customer of transaction volume, financial stability, and particulars such as employee count, few privately held companies will hold back this information, although most report this data as a range.

I selected Zhejiang Tea Group (ZTG) for a closer look. I know the company well, and have visited the firm’s gardens, toured its factories and dined with the company’s top executives in the U.S. and China. The firm has a U.S. distribution office in New Jersey. Annual sales, according to BizVibe’s BizScore, are in the range $11–100 million. Employees were estimated at 100 to 500.

Publicly held companies are legally required to publish vital details about their business operations. Regulators police this information and auditors, investors, and the stock market analysts severely punish firms that mislead shareholders.

Private companies are much more difficult to research. The real test of discovery on an e-commerce platform is looking at what is available about privately held companies. In this instance, BizVibe returned very little information of value. The category, location of the headquarters offices, and website is correct but annual revenue at ZTG is significantly greater than $100 million. In fact, the company is the world’s largest supplier of green tea. Alibaba noted that in 2005 ZTG ranked 329th among China’s 500 largest importers by volume and ZTG ranked 190th for revenue among the top 200 biggest exporters. ZTG was founded in 1950 and has been selling tea in the U.S. since 1995. The company has grown significantly in the decades since the 2005 Alibaba update, but providing fresh details is voluntary and obviously not a high priority for ZTG.

In practice, companies routinely provide business information to potential customers in much greater detail. If a sale hinges on reassuring a big customer of transaction volume, financial stability, and particulars such as employee count, few privately held companies will hold back this information, although most report this data as a range.

ZTG has been listed on the Alibaba site the past 11 years. It is recognized as a “gold supplier.” There are hundreds of products available for wholesale. The company profile includes a 450-word description with important details about the company history, hectares in production, market reach (63 countries), and brands. Camel Transworld (1998) and Shifeng are the two most important. The three top markets served are listed with a breakdown by percent of share: Africa (Morocco) represents 30 percent of total exports. The Chinese domestic market is the next largest at 20 percent and North America is the third most important trading partner at 20 percent. Sales to Western Europe (16 percent), Eastern Asia (5 percent), Eastern Europe (4 percent), Southeast Asia (3 percent), and the Middle East (2 percent) are much more helpful than BizVibe's information. Alibaba goes on to name key contacts at the company, describe the number of employees on the sales staff. A separate tab displays the ZTG certifications, each of which is posted and available for inspection or download. These include ISO9001, IMO Organic certifications, and awards a total of 12 are posted.

General information. Bots racing around the internet are getting pretty good at scraping readily available company information such as business addresses and phone (and general email addresses). In addition to the China tea market, during the last few months BizVibe updated markets as varied as sugar in Brazil, auto parts companies in Japan, vinegar vendors in Italy, rice suppliers in India, olive oil pressed in Spain, and marble traders mining in Turkey. The BizVibe platform connects global trade professionals with more than 7 million prospecting and sourcing candidates in more than 700 industries.

This make BizVibe somewhat helpful in identifying the largest, most internet savvy and well-financed e-commerce vendors. By comparison, the information on LinkedIn was much less accurate, although you could send a message to company sales representatives by name and to some company executives including CEO MAO, Limin (via company email). Bloomberg displayed only the company name and address and did not include a business profile. No executives were listed. D&B Hoovers offers a detailed report with revenue estimates for all five ZTG affiliates―for a price. Alibaba is free and listed the ZTG trade manager’s name, title, phone, address, and email details with every product.

The ideal of sitting at your desk, investing a few hours in researching potential suppliers, and benefiting from rich-data is far from reality.

Ranking transactions and response time. During the past 11 years, Alibaba has directed thousands of queries to ZTG but among the 63 countries with which it does business, only two transactions, both shipped to Cameroon, are listed. These occurred in October and December of 2016. The number is too low for an accurate ranking as scores require a minimum of several hundred transactions. Ranking the number and amount of transactions is useful and will establish meaningful patterns but ZTG is using Alibaba as a tip service and to market its products. Hundreds of thousands of transactions were outside the platform. There is some evidence smaller firms benefit when they take the time to enrich and update their profile, immediately jump on leads, and more effectively market their products.

General information. Bots racing around the internet are getting pretty good at scraping readily available company information such as business addresses and phone (and general email addresses). In addition to the China tea market, during the last few months BizVibe updated markets as varied as sugar in Brazil, auto parts companies in Japan, vinegar vendors in Italy, rice suppliers in India, olive oil pressed in Spain, and marble traders mining in Turkey. The BizVibe platform connects global trade professionals with more than 7 million prospecting and sourcing candidates in more than 700 industries.

This make BizVibe somewhat helpful in identifying the largest, most internet savvy and well-financed e-commerce vendors. By comparison, the information on LinkedIn was much less accurate, although you could send a message to company sales representatives by name and to some company executives including CEO MAO, Limin (via company email). Bloomberg displayed only the company name and address and did not include a business profile. No executives were listed. D&B Hoovers offers a detailed report with revenue estimates for all five ZTG affiliates―for a price. Alibaba is free and listed the ZTG trade manager’s name, title, phone, address, and email details with every product.

The ideal of sitting at your desk, investing a few hours in researching potential suppliers, and benefiting from rich-data is far from reality.

Ranking transactions and response time. During the past 11 years, Alibaba has directed thousands of queries to ZTG but among the 63 countries with which it does business, only two transactions, both shipped to Cameroon, are listed. These occurred in October and December of 2016. The number is too low for an accurate ranking as scores require a minimum of several hundred transactions. Ranking the number and amount of transactions is useful and will establish meaningful patterns but ZTG is using Alibaba as a tip service and to market its products. Hundreds of thousands of transactions were outside the platform. There is some evidence smaller firms benefit when they take the time to enrich and update their profile, immediately jump on leads, and more effectively market their products.

Quanzhou Weidao Import & Export Co., an oolong supplier based in Fujian, is new and actively trading on Alibaba, joining in 2017. The 150-word company profile is complete with photos, production volume estimates of 50,000 kilos, and annual revenue estimated at $5 million. The company brand is Weiyin Tea. The top export markets are Western Europe (20 percent), Eastern Europe (15 percent), and North America (15 percent). Weidao has a response rate under 24 hours for 88.2 percent of the buyers who contacted the firm via Alibaba (compared to an average seven-day response time for the site overall). Quanzhou has provided four quotes to buyers in the past 30 days.

Specialty tea. Seasonal variation in harvests, the introduction of nontraditional specialty teas, and a quick response to changing market conditions require human skills deeply embedded in professional trade desks. Add to that a mastery of the logistics necessary for handling tea from trusted suppliers with decades-long histories of interaction. That is why very few online solutions rise to the level of usefulness comparable to the services provided by the trading desk of a reputable importer.

Several “tea-commerce” websites are experimenting with direct trade online. Tealet, based in Las Vegas, U.S. is a good example. Founder Elyse Petersen travels to origin to vouch for the growers, assembles marketing material and story details with video critical to selling artisan tea. Her willingness to ship small quantities globally relieves small growers of one of their more daunting challenges. Vahdam Tea in India and Teasenz in Hong Kong are other ventures marketing on behalf of small farmers. Vahdam has a network of suppliers that package and ships via air. Teasenz specializes in Chinese teas and ships from Shenzhen. Both firms offer quality curation at the garden, eliminate costly middlemen, and balance retail expectations with better prices for the farmer.

By creating incentives to enrich its trove of data BizVibe could evolve into a superior online engine for tea discovery but it’s not there yet.

Quanzhou Weidao Import & Export Co., an oolong supplier based in Fujian, is new and actively trading on Alibaba, joining in 2017. The 150-word company profile is complete with photos, production volume estimates of 50,000 kilos, and annual revenue estimated at $5 million. The company brand is Weiyin Tea. The top export markets are Western Europe (20 percent), Eastern Europe (15 percent), and North America (15 percent). Weidao has a response rate under 24 hours for 88.2 percent of the buyers who contacted the firm via Alibaba (compared to an average seven-day response time for the site overall). Quanzhou has provided four quotes to buyers in the past 30 days.

Specialty tea. Seasonal variation in harvests, the introduction of nontraditional specialty teas, and a quick response to changing market conditions require human skills deeply embedded in professional trade desks. Add to that a mastery of the logistics necessary for handling tea from trusted suppliers with decades-long histories of interaction. That is why very few online solutions rise to the level of usefulness comparable to the services provided by the trading desk of a reputable importer.

Several “tea-commerce” websites are experimenting with direct trade online. Tealet, based in Las Vegas, U.S. is a good example. Founder Elyse Petersen travels to origin to vouch for the growers, assembles marketing material and story details with video critical to selling artisan tea. Her willingness to ship small quantities globally relieves small growers of one of their more daunting challenges. Vahdam Tea in India and Teasenz in Hong Kong are other ventures marketing on behalf of small farmers. Vahdam has a network of suppliers that package and ships via air. Teasenz specializes in Chinese teas and ships from Shenzhen. Both firms offer quality curation at the garden, eliminate costly middlemen, and balance retail expectations with better prices for the farmer.

By creating incentives to enrich its trove of data BizVibe could evolve into a superior online engine for tea discovery but it’s not there yet.

I selected Zhejiang Tea Group (ZTG) for a closer look. I know the company well, and have visited the firm’s gardens, toured its factories and dined with the company’s top executives in the U.S. and China. The firm has a U.S. distribution office in New Jersey. Annual sales, according to BizVibe’s BizScore, are in the range $11–100 million. Employees were estimated at 100 to 500.

Publicly held companies are legally required to publish vital details about their business operations. Regulators police this information and auditors, investors, and the stock market analysts severely punish firms that mislead shareholders.

Private companies are much more difficult to research. The real test of discovery on an e-commerce platform is looking at what is available about privately held companies. In this instance, BizVibe returned very little information of value. The category, location of the headquarters offices, and website is correct but annual revenue at ZTG is significantly greater than $100 million. In fact, the company is the world’s largest supplier of green tea. Alibaba noted that in 2005 ZTG ranked 329th among China’s 500 largest importers by volume and ZTG ranked 190th for revenue among the top 200 biggest exporters. ZTG was founded in 1950 and has been selling tea in the U.S. since 1995. The company has grown significantly in the decades since the 2005 Alibaba update, but providing fresh details is voluntary and obviously not a high priority for ZTG.

In practice, companies routinely provide business information to potential customers in much greater detail. If a sale hinges on reassuring a big customer of transaction volume, financial stability, and particulars such as employee count, few privately held companies will hold back this information, although most report this data as a range.

I selected Zhejiang Tea Group (ZTG) for a closer look. I know the company well, and have visited the firm’s gardens, toured its factories and dined with the company’s top executives in the U.S. and China. The firm has a U.S. distribution office in New Jersey. Annual sales, according to BizVibe’s BizScore, are in the range $11–100 million. Employees were estimated at 100 to 500.

Publicly held companies are legally required to publish vital details about their business operations. Regulators police this information and auditors, investors, and the stock market analysts severely punish firms that mislead shareholders.

Private companies are much more difficult to research. The real test of discovery on an e-commerce platform is looking at what is available about privately held companies. In this instance, BizVibe returned very little information of value. The category, location of the headquarters offices, and website is correct but annual revenue at ZTG is significantly greater than $100 million. In fact, the company is the world’s largest supplier of green tea. Alibaba noted that in 2005 ZTG ranked 329th among China’s 500 largest importers by volume and ZTG ranked 190th for revenue among the top 200 biggest exporters. ZTG was founded in 1950 and has been selling tea in the U.S. since 1995. The company has grown significantly in the decades since the 2005 Alibaba update, but providing fresh details is voluntary and obviously not a high priority for ZTG.

In practice, companies routinely provide business information to potential customers in much greater detail. If a sale hinges on reassuring a big customer of transaction volume, financial stability, and particulars such as employee count, few privately held companies will hold back this information, although most report this data as a range.

Alibaba Business Profile

Alibaba Business Profile

ZTG has been listed on the Alibaba site the past 11 years. It is recognized as a “gold supplier.” There are hundreds of products available for wholesale. The company profile includes a 450-word description with important details about the company history, hectares in production, market reach (63 countries), and brands. Camel Transworld (1998) and Shifeng are the two most important. The three top markets served are listed with a breakdown by percent of share: Africa (Morocco) represents 30 percent of total exports. The Chinese domestic market is the next largest at 20 percent and North America is the third most important trading partner at 20 percent. Sales to Western Europe (16 percent), Eastern Asia (5 percent), Eastern Europe (4 percent), Southeast Asia (3 percent), and the Middle East (2 percent) are much more helpful than BizVibe's information. Alibaba goes on to name key contacts at the company, describe the number of employees on the sales staff. A separate tab displays the ZTG certifications, each of which is posted and available for inspection or download. These include ISO9001, IMO Organic certifications, and awards a total of 12 are posted.

Here Are Three Takeaways

General information. Bots racing around the internet are getting pretty good at scraping readily available company information such as business addresses and phone (and general email addresses). In addition to the China tea market, during the last few months BizVibe updated markets as varied as sugar in Brazil, auto parts companies in Japan, vinegar vendors in Italy, rice suppliers in India, olive oil pressed in Spain, and marble traders mining in Turkey. The BizVibe platform connects global trade professionals with more than 7 million prospecting and sourcing candidates in more than 700 industries.

This make BizVibe somewhat helpful in identifying the largest, most internet savvy and well-financed e-commerce vendors. By comparison, the information on LinkedIn was much less accurate, although you could send a message to company sales representatives by name and to some company executives including CEO MAO, Limin (via company email). Bloomberg displayed only the company name and address and did not include a business profile. No executives were listed. D&B Hoovers offers a detailed report with revenue estimates for all five ZTG affiliates―for a price. Alibaba is free and listed the ZTG trade manager’s name, title, phone, address, and email details with every product.

The ideal of sitting at your desk, investing a few hours in researching potential suppliers, and benefiting from rich-data is far from reality.

Ranking transactions and response time. During the past 11 years, Alibaba has directed thousands of queries to ZTG but among the 63 countries with which it does business, only two transactions, both shipped to Cameroon, are listed. These occurred in October and December of 2016. The number is too low for an accurate ranking as scores require a minimum of several hundred transactions. Ranking the number and amount of transactions is useful and will establish meaningful patterns but ZTG is using Alibaba as a tip service and to market its products. Hundreds of thousands of transactions were outside the platform. There is some evidence smaller firms benefit when they take the time to enrich and update their profile, immediately jump on leads, and more effectively market their products.

General information. Bots racing around the internet are getting pretty good at scraping readily available company information such as business addresses and phone (and general email addresses). In addition to the China tea market, during the last few months BizVibe updated markets as varied as sugar in Brazil, auto parts companies in Japan, vinegar vendors in Italy, rice suppliers in India, olive oil pressed in Spain, and marble traders mining in Turkey. The BizVibe platform connects global trade professionals with more than 7 million prospecting and sourcing candidates in more than 700 industries.

This make BizVibe somewhat helpful in identifying the largest, most internet savvy and well-financed e-commerce vendors. By comparison, the information on LinkedIn was much less accurate, although you could send a message to company sales representatives by name and to some company executives including CEO MAO, Limin (via company email). Bloomberg displayed only the company name and address and did not include a business profile. No executives were listed. D&B Hoovers offers a detailed report with revenue estimates for all five ZTG affiliates―for a price. Alibaba is free and listed the ZTG trade manager’s name, title, phone, address, and email details with every product.

The ideal of sitting at your desk, investing a few hours in researching potential suppliers, and benefiting from rich-data is far from reality.

Ranking transactions and response time. During the past 11 years, Alibaba has directed thousands of queries to ZTG but among the 63 countries with which it does business, only two transactions, both shipped to Cameroon, are listed. These occurred in October and December of 2016. The number is too low for an accurate ranking as scores require a minimum of several hundred transactions. Ranking the number and amount of transactions is useful and will establish meaningful patterns but ZTG is using Alibaba as a tip service and to market its products. Hundreds of thousands of transactions were outside the platform. There is some evidence smaller firms benefit when they take the time to enrich and update their profile, immediately jump on leads, and more effectively market their products.

Quanzhou Weidao Import & Export Co., an oolong supplier based in Fujian, is new and actively trading on Alibaba, joining in 2017. The 150-word company profile is complete with photos, production volume estimates of 50,000 kilos, and annual revenue estimated at $5 million. The company brand is Weiyin Tea. The top export markets are Western Europe (20 percent), Eastern Europe (15 percent), and North America (15 percent). Weidao has a response rate under 24 hours for 88.2 percent of the buyers who contacted the firm via Alibaba (compared to an average seven-day response time for the site overall). Quanzhou has provided four quotes to buyers in the past 30 days.

Specialty tea. Seasonal variation in harvests, the introduction of nontraditional specialty teas, and a quick response to changing market conditions require human skills deeply embedded in professional trade desks. Add to that a mastery of the logistics necessary for handling tea from trusted suppliers with decades-long histories of interaction. That is why very few online solutions rise to the level of usefulness comparable to the services provided by the trading desk of a reputable importer.

Several “tea-commerce” websites are experimenting with direct trade online. Tealet, based in Las Vegas, U.S. is a good example. Founder Elyse Petersen travels to origin to vouch for the growers, assembles marketing material and story details with video critical to selling artisan tea. Her willingness to ship small quantities globally relieves small growers of one of their more daunting challenges. Vahdam Tea in India and Teasenz in Hong Kong are other ventures marketing on behalf of small farmers. Vahdam has a network of suppliers that package and ships via air. Teasenz specializes in Chinese teas and ships from Shenzhen. Both firms offer quality curation at the garden, eliminate costly middlemen, and balance retail expectations with better prices for the farmer.

By creating incentives to enrich its trove of data BizVibe could evolve into a superior online engine for tea discovery but it’s not there yet.

Quanzhou Weidao Import & Export Co., an oolong supplier based in Fujian, is new and actively trading on Alibaba, joining in 2017. The 150-word company profile is complete with photos, production volume estimates of 50,000 kilos, and annual revenue estimated at $5 million. The company brand is Weiyin Tea. The top export markets are Western Europe (20 percent), Eastern Europe (15 percent), and North America (15 percent). Weidao has a response rate under 24 hours for 88.2 percent of the buyers who contacted the firm via Alibaba (compared to an average seven-day response time for the site overall). Quanzhou has provided four quotes to buyers in the past 30 days.

Specialty tea. Seasonal variation in harvests, the introduction of nontraditional specialty teas, and a quick response to changing market conditions require human skills deeply embedded in professional trade desks. Add to that a mastery of the logistics necessary for handling tea from trusted suppliers with decades-long histories of interaction. That is why very few online solutions rise to the level of usefulness comparable to the services provided by the trading desk of a reputable importer.

Several “tea-commerce” websites are experimenting with direct trade online. Tealet, based in Las Vegas, U.S. is a good example. Founder Elyse Petersen travels to origin to vouch for the growers, assembles marketing material and story details with video critical to selling artisan tea. Her willingness to ship small quantities globally relieves small growers of one of their more daunting challenges. Vahdam Tea in India and Teasenz in Hong Kong are other ventures marketing on behalf of small farmers. Vahdam has a network of suppliers that package and ships via air. Teasenz specializes in Chinese teas and ships from Shenzhen. Both firms offer quality curation at the garden, eliminate costly middlemen, and balance retail expectations with better prices for the farmer.

By creating incentives to enrich its trove of data BizVibe could evolve into a superior online engine for tea discovery but it’s not there yet.