In a world breathing in fresh air, not through the restriction of masks, life seems freer and that much better. While the COVID-19 pandemic was devastating for people around the globe, one cannot ignore the lasting impact that this global event had on the tea industry. As a result, since 2020 and the on-set of COVID, tea commerce has looked promising, though not without some serious issues.

In this report, we’ll take an in-depth look at the overall tea category, using the dynamics realized during the COVID-19 pandemic. For context, we’re referring to COVID-19 purely as an inflection point, which brought significant focus on health and wellness trends and the benefits of tea (overlooking the many horrible aspects of COVID).

Indeed, when considering tea trends that came about as a result of the COVID-19 pandemic, it’s important to recognize the loss of the many brick-and-mortar establishments that served and sold tea. Be they independent grocers, retailers, cafés or restaurants, these now closed establishments have changed the tea channel forever.

Along that same line of thought, perpetuated by the pandemic’s “stay at home” orders and, thus, a subsequent reduction of workers who physically visit offices on a daily basis, tea consumers have become more elusive.

Yes, the horror story of the pandemic led to a “bad news / good news” scenario for tea, which will always be an at-home beverage at its core, reminding us that the tea industry does not have to remain the same just because it’s convenient.

Tea on Trend

Post pandemic and with time to reflect, one might think the good news was that with many more people at home during COVID, tea was fit for purpose and it experienced incredible increases in overall sales, as people got online and executed some much-needed retail therapy while sitting out the viral storm.

Of course, all retail categories were shopped online but tea more than most. The anxiety felt by many during COVID, and the need to protect oneself from illness, put a focus on a category that evokes calm and is intuitively healthy.

So, what’s the hangover from this momentous event and the tea trade’s reactions to it? Have tea businesses sustained or seen increased sales? Was their success a blip? What’s the direction for tea now?

The answer is likely that the COVID-19 “event” was nothing more than an accelerant of infant stages of existing trends that will continue to grow and mature.

The evidence of what we’re witnessing is really learning turned on its head, rather than the young learning from the old. It’s the Gen Z generation that was already living online, working online and, frankly, being anxious before the rest of us, that is leading the way for tea.

Diversification of Plant Species for the Tea Category

Firstly and oft repeated, the tea industry has to acknowledge that “tea” embraces all those botanical infusions – barring coffee, cacao and a few malted beverages – made with hot or cold water.

The overarching theme of the last decade has been one of consumer discovery manifested through diversification – of plant species, channel, brand and format in that order.

Not new or news, but the trend continues with botanical teas, and its seems to radicalize with every coming year. Of course, there have been herbal teas around for years, but these have focused on sensorially appealing cups, often flavored. Yet, how many of us would have committed to buying straight milk thistle tea five years ago? Today, the plethora of milk thistle offerings and other botanical tea products is truly staggering.

This clear liquoring and, well, “blandish” (writer’s personal view) herbal cup exists on stated benefits and is scooped up with others (not all bland!), all for the collective “wellness” that they promise. This is evidence of a consumer shift in category priority, from sensory to benefit and of brands trying to find fresh space in a “carpet bombed” category.

I should clarify and state that this “health and wellness” herbal focus is a subcategory of tea and that sensory is still a priority for other parts of the same industry, but the growth supports this predominant reason to buy.

So, two evidential changes in one:

1. The continued march of naturally available health as a reason to buy botanical teas.

2. A new deliberate shift to align offerings as part of a healthy diet with more single botanicals being sold than before, mimicking healthy foods and gravitating towards simple labeling to boot. If the strategy was not clear enough already, consider the additional yet superfluous marketing claims that are out there – “vegan friendly,” “part of a plant-based diet” and “nut free” (seriously?)

But what about Camellia sinensis, that which has the majority of actual scientifically backed health claims?

On this single focus, despite the unequivocal benefits of tea and the consumer understanding of this, the line in the sand seems to be drawn between caffeinated and caffeine free beverages – an erroneous but simple pathway to follow for consumers.

Channel Change and Opportunity

Nonetheless, despite the massive growth in botanical tea products, camellia sinensis tea has enjoyed significant market gains, too. The new health focus has certainly done no harm to tea, and the more time that consumers were locked down during the pandemic, it enabled them to browse the extensive online tea offerings and to experiment with disregard for format, with convenience having moved down a rung or two on the priority ladder (as time at home allowed).

This channel shift had already begun way before COVID, as Gen Zs – a generation of consumers who look online first for mind and body sustenance – demanded brands to respond.

There is, arguably, no way back for traditional grocery in the tea category, other than for innovative and well packaged ready-to-drink (RTD) offerings. Yes, RTD remains the predominant purchase channel for tea, but demographics are not in their favor.

So, what has a shift online done for tea? It has emancipated it from the constraints of:

- Traditional advertising

- Cost of entry

- Distribution, marketing and sales support

- Packaging criteria (format, dimensions and information)

- Selling price constraints

The No. 1 Issue: Category Brand Influence

“With great power comes”… well, no responsibility, really!

The influence of big CPG (consumer packaged goods) tea companies has been diluted by the tea’s channel shift. That’s not to say that big CPG tea companies aren’t able to successfully play in the market; it just means that every tea business and any tea business can play! The online space has no selection process. There is no “push” required in this new, democratized marketplace. The channel is now totally blind to a business’s pedigree, which is both refreshing and dangerous.

It would be a fair assumption that, had the tea category remained in the hands of multi-national CPG players, then the associated health and wellness claims of many products in the category would not have been made or heard, as internal compliance would have nixed the many outrageous claims. If many CPG tea companies had made these claims – all nicely washed with declarative statements, like so many online offerings – then consumers would have been running to their local grocery store for tea.

The truth is, many multi product CPGs have been running from tea. Unilever selling its tea business lock stock and teabag is the most dramatic example, but not the only sell-off.

The ensuing “wild west” – or, given the international reach, “west and east” – has changed the tea category’s landscape, broadening it and muting any single discernible industry voice. There is just no harnessing all the new entrants in the marketplace by tea boards, associations and other collective industry bodies; though, there have been some extraordinary efforts, with many making good headway in difficult seas. However, there is no reigning in of claims and no end to the varietals, sustainable or fair sourcing claims that are being made by many smaller tea brands. In short, a lack of verifiable, consistent messaging across a category makes one ripe for the picking… off.

Trends in Format

The final visible impact of the COVID-19 pandemic on the tea category is the lack of format distinction.

With the loss of grocery aisle stricture for tea, so goes the uniformity of packaging and counts. Now the priorities are based on other criteria, including:

- No packaging constraints, which opens up the marketplace to anyone, and formats reflect this.

- Loose tea product offerings, which are growing (as any tea business can pack them).

- Soft packaging is growing (again, any business can pack them).

- Price points (diversified offerings based on varied cost structures and margin goals).

- Shipping costs (efficient loadings to minimize fulfilment costs) .

Finally, the increase in compostable, plastic free and, overall, packaging reduction is gaining pace, but (and there’s always a but) the irony of an efficient brand package being mailed in a marketplace’s generic ”best fit” shipper begs an ethical question that will come under scrutiny sooner or later.

A Global Trend: Developed vs. Developing Markets – a Distinction Blurred

This new marketplace and virtual world, in which young cohorts work and live, has helped to homogenize disparate existences into a common (er) community, where TikTok is more likely to mold ideals and desires than any existing physical apparatus. It is a fact that peer reviews are more relevant to these consumers than traditional advertising, and so it is logical that, within the tea category, we are seeing the same consumption homogenization. This is of concern to the Camellia sinensis sub category, which has enjoyed generations of staunch support where it is grown, as well as overseas.

Both China and India – two vast producers and vital consumers – are seeing their domestic Camellia sinensis market chipped away at by herbals and other beverages, including coffee. It’s a long and slow road impacted by wealth, population growth and fulfilment capacities (among others), but it is happening and demands action at the top of the tea industry’s supply chains.

Of course, it’s important to note, if it hasn’t escaped your attention, that the world is producing too much tea and of the wrong quality, and there are a litany of issues stacked against producers to satisfy the needs of developed markets. Indeed, that’s a topic to explore at a later time, but it’s worth noting here.

Definition of Market Value Will Change – Tea Sale Mechanisms, Information Flow

Another issue in all of this is the homogenization of tea through blending. This obscures the consumer’s view to the art of the possible, with respect to quality. And retail pricing belies the true cost of production, driven by regional competitive environments rather than an evaluation of sustainable supply. This is not a conscious obfuscation but one that is convenient and defensible, when transparency is lacking.

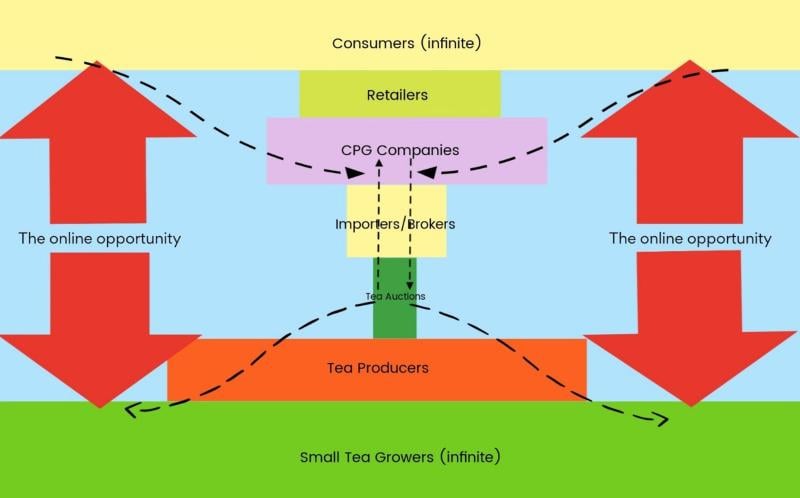

The key problem is shown below (see graph), where the bottle neck for communication is the current sales mechanisms, auctions and private sales, conducted via import/exporters and brokers (dotted line represents the current flow). This is not an incrimination of the practices of these actors, who are integral to the historical fashion in which tea is traded, but it does beg the question whether it is fit for purpose.

As has been noted, each new generation is living online more and more, and the blue space on the above diagram represents opportunity for a more efficient and transparent exchange from top to bottom. The question is how will this be utilized?

The first changes in our industry are here, with electronic auctions that enable buyers to engage in weekly sales, internationally. This is highly encouraging that a well-entrenched and fusty industry can find ways to modernize itself with innovative thinking. However, this has not broadened the bottleneck by much, and the needs of both consumers and producers will (in this author’s opinion), dictate the emergence of more transparent, democratic processes (such as smart contracts) in the near future. These will need to verify and enable minimum sustainable pricing and deliver quality expectations to be an effective “sales room.”

The push back from industry will only last as long as market forces allow, but as consumers have and continue to move online and demand a deeper and more appropriate set of values for their money, capitulation will follow and a resilient industry will move forward healthier than before.

John Snell, NMTeaB Consultancy, has spent 40 years in the tea industry, working with everyone from global brand leaders to traders and private label packers, in management of procurement, development and sustainability. His day job is now consulting for those that “do not want to spend 35 years trying,” in his words, and work ranges from product development and go-to-market strategies to international development projects. Snell has spent the last 30 years in North America, where he has been an active member of the trade, sitting on the board of the Tea Association of the USA and presents at industry events like World Tea Expo and the North American Tea Conference. He sits on the Canadian Tea Association’s grading panel and is a regular contributor to World Tea News. If you ask him what “floats his boat” (a relevant analogy given his earlier days in the Royal Navy), it is always about empowering others to arrive at responsibly derived beverage solutions that deliver outstanding results for the companies he works for. He is clear that sustainably sourced and produced products are more profitable. To learn more, visit nmteab.com.

Don’t Miss the Weekly World Tea News eNewsletter! Get your free subscription, if you’re not already subscribed, by clicking here.

Plan to Attend or Participate in World Tea Expo, March 18-20, 2024

To learn about other key developments, trends, issues, hot topics and products within the global tea community, plan to attend World Tea Expo, March 18-20, 2024 in Las Vegas, co-located with Bar & Restaurant Expo. Visit WorldTeaExpo.com.

To book your sponsorship or exhibit space at the World Tea Conference + Expo, or to enquire about advertising and sponsorship opportunities at World Tea News, contact:

Ellainy Karaboitis-Christopoulos

Business Development Manager, Questex

Phone: +1-212-895-8493

Email: [email protected]

Also, be sure to stay connected with World Tea Expo on social media for details and insights about the event. Follow us on Twitter, Facebook, Instagram and LinkedIn.