If one thing is for certain, it is that nothing is forever – and that goes for the current supply chain issues for tea, too.

In our first look at supply chain (if you missed Part One of this series, you can read it here at World Tea News), we considered the impacts of the COVID-19 pandemic and the war in Ukraine, but there will come a time when both end or, at least, the consequences of the former will diminish and the latter will end.

The question is, really, what happens next?

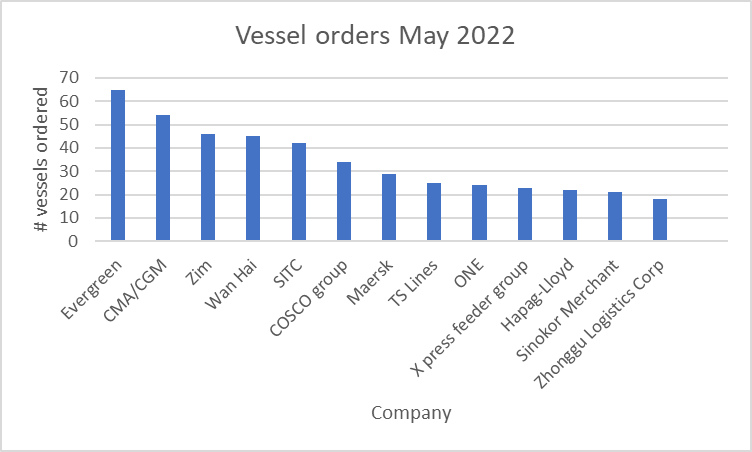

Currently, shipping companies are increasing and accelerating orders for new vessels (deliveries in 2023 and onwards) and containers are being built to replace those stuck in ports across the Pacific (predominantly). Indeed, no one plans on missing out on the boom.

New Vessels Order Booked for April 2022

With rates stratospherically high (some suggest not entirely market driven) the investment community has piled in too, and this group can exacerbate market trends.

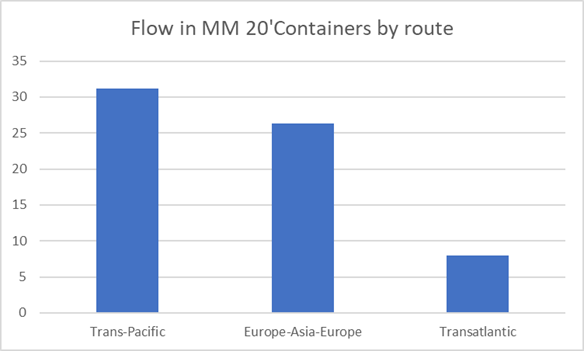

Route Share in MM 20’ Container Units

A Future Crash?

So, is there an inevitable crash coming, a shipping company “Mea culpa” moment, when they have to plead for business to fill all that additional hardware (now financed at higher rates)? Will this be accelerated by the rapid exit of the rabid investors, who like to be first in and first out, when markets turn?

I think not. As the saying goes, “Up like a rocket, down like a feather,” and the likelihood is that while capacity will increase, relieving some of the need for excessive inventory will hold and the natural growth in consumption patterns will remain and accelerate, as does e-commerce/online shopping, which is the more pressing issue.

The Online Shopping Factor

Consider that COVID-19 not only created the port slowdowns but dramatically increased online shopping, a supply chain that has enabled companies to sell without the need for manufacturing. This vast cohort buys consumer packaged goods (CPG) from someone else (predominantly “offshore”) rather than importing raw materials, for conversion in the sale market, which is critical for a number of factors but one specific to this trade.

The “Volumizing” of Trade

The voluminous nature of shopper-ready product exacerbates the imbalance in container traffic.

Looking at tea, specifically, a 40’ FCL (full container load) can carry approximately 22 MT of bulk teabag cut grades, palletized. However, if this same tea were to be packed into teabags of two grms and shipped over in standard 20-count retail ready cartons, palletized, the total weight of tea would be less than 10 percent of this (2.1 MT net). For a pallet of 435 FG (finished goods) cases, the total net weight of tea would equal 104.4 Kgs.

Below, pallets of bulk tea awaiting shipment. Net weight of tea 1,100 to 1,400 Kgs/pallet.

This 10-fold volume effect is an example of the impact that is felt in many other categories and, one reason, why we have mountains of empty containers sitting in United States and European ports. Inland, too, we witness – as consumers – the simplification of packaging options leading to inefficient space use (consider your last Amazon purchase and the space in the box).

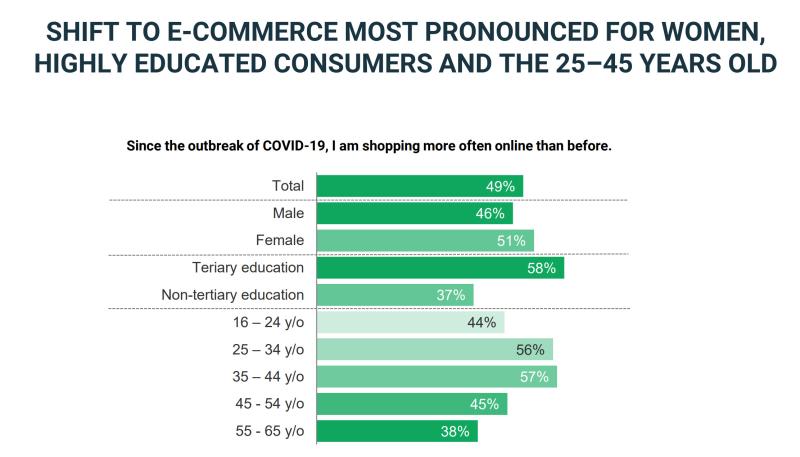

From a tea perspective, the United Nations Conference on Trade and Development (UNCTAD) survey, Covid-19 and E-Commerce, revealed that online shopping increased most with people with tertiary education and females, conveniently dovetailing with those predominant tea drinkers.

This offers a quandary to all, including the tea industry. As freight increases and packers try to manage costs, there tends to be downward price pressure on origins, where returns are already marginal. Solutions to this need more investigation, but producers can try enacting vertical integration strategies, which has proven successful in some cases – such as Sri Lanka, among others.

However, a 10:1 ratio in freight costs/standard weight becomes a more significant issue as freight climbs. A $20,000 freight rate may be $0.90/kg in the raw material example (above), but for packaged tea, it equates to $9.50/kg or almost two cents per serving! Beyond the freight volume there lies other constraints, including retailer demands on SSL (shippable shelf life), made ever more difficult to satisfy with today’s longer transit times. These delays also necessitate longer stock holdings (and cashflow requirements) and decrease flexibility.

So, What Can We Expect in the Future?

There will be a return to lower freight rates whatever the shipping industry wants to project today. Not as low as the floor from which they came, but a 50 percent reduction off the table by late 2023? No. Supply and demand is not only an issue for the tea industry but for their supply chain partners, too. There will come a time when the practices of non-binding freight rate contracts, ransomed space bookings, and virtual auction environments for that available space will go away – it has to.

The shipping companies will partner with industry, again, to avoid a decline beyond their extraordinary financial commitments, but the backslide will be checked. It will be checked by pushing back on new vessel orders, cutting short leases, accelerating end-of-life/leases for vessels and a continued dialogue with each other – all to avoid the unsustainable environment of the past.

It may be aided by a cessation of Russian oil and gas, an ever more unlikely event. However, if it happens, then the continuation of higher oil prices will surely help their arguments.

I would like to think that governments will have a say in this too, that carbon taxing will become a sizable part of logistic cost, and that going forward we may see slower steaming speeds, route management (to ensure capacity shipments), and higher e-commerce costs reflective of its fair share of the supply chain footprint. This, of course, is inflationary for transport of all types, but should be welcomed as a necessity and a focal point for ongoing efficient supply chain initiatives.

For the moment, it is fair to assume that with COVID-19 waning – and regardless of Ukraine – we will/are seeing a return to some normality. However, the horse named “online shopping” has bolted and there is no stopping her. The only thing that may act as “soft going” in this equestrian analogy is rising inflation and the tools put in place by governments everywhere to try to get this in check.

If discretionary purchases take a hit, then we could see some pressure alleviated during the next 18 months which, as predicted earlier, will see us back at rates lower than today.

John Snell, NMTeaB Consultancy, has spent 40 years in the tea industry, working with everyone from global brand leaders to traders and private label packers, in management of procurement, development and sustainability. His day job is now consulting for those that “do not want to spend 35 years trying,” in his words, and work ranges from product development and GTM strategies to international development projects. Snell has spent the last 27 years in North America, where he has been an active member of the trade, sitting on the board of the Tea Association of the USA and as a regular speaker at North American tea conferences. He sits on the Canadian Tea Association’s grading panel and is a regular contributor to World Tea News. If you ask him what “floats his boat” (a relevant analogy given his earlier days in the Royal Navy), it is always about empowering others to arrive at responsibly derived beverage solutions that deliver outstanding results for the companies he works for. He is clear that sustainably sourced and produced products are more profitable. To learn more, visit nmteab.com.

Plan to Attend or Participate in the

World Tea Conference + Expo, March 27-29, 2023

To learn about other key developments, trends, issues, hot topics and products within the global tea community, plan to attend the World Tea Conference + Expo, March 27-29, 2023 in Las Vegas, co-located with Bar & Restaurant Expo. Visit WorldTeaExpo.com.

To book your sponsorship or exhibit space at the World Tea Conference + Expo, or to enquire about advertising and sponsorship opportunities at World Tea News, contact:

Ellainy Karaboitis-Christopoulos

Business Development Manager, Questex

Phone: +1-212-895-8493

Email: [email protected]

Also, be sure to stay connected with the World Tea Conference + Expo on social media for details and insights about the event. Follow us on Twitter, Facebook, Instagram and LinkedIn.