2022 was a year in which COVID-19 finally began to take a backseat. Consumers emerged from their homes and the economy began to open more fully. Unfortunately, inflation – driven by supply chain costs, shipment imbalances, low unemployment and government spending – reached levels not seen for 40 years, averaging eight percent for 2022 (1981 was 10.33 percent). This level of inflation certainly impacted cost of goods and apparent growth rates in dollar terms.

Overall, the tea market grew in 2022 in both imports and dollars. In reviewing tea import figures for the year, total tea imports were 4.3 percent up in volume terms. Black tea imports exceeded 2021 by more than 5.1 percent with green tea softening slightly by less than two percent year-on-year. Surprisingly, 2022 organic imports were down by about 40 percent vs. 2021.

As we have been reporting over the last few years, consumers continued to turn to tea during COVID. Further, subsequent qualitative work indicated the at-home consumption remained high, while the likelihood for consumers to consume tea out of home declined. The hybrid way of working, with many workers continuing to split time between the office and home, will help sustain gains in consumption trends.

Tea has demonstrated it is capable of acting as an enabler for de-stressing, as well providing a feeling of “centeredness,” particularly for Gen Zs and Millennials. Not only did they increase their consumption, but research after COVID indicated that about 70 percent would continue to drink tea at the higher rate. This is great news and highlights the importance of tracking demographic behavior as both a marketing tool and to provide insight for product development, brand and product messaging and optimizing communication pathways.

Further, consumers are looking for specific health and wellness benefits from their food and beverages, placing that above sustainability, according to Tastewise’s 2023 trend report. While health and wellness and international flavors have been trending in food and drink for years, this report shows preferences are evolving and consumers are zeroing in on specific niches that interest them.

These trends complement tea’s strong position as a plant-based, healthful drink, consumed for its variety of benefits, rooted in its high flavonoid content. In fact, several new research papers were published in 2020 and 2021 illustrating tea’s extraordinary ability to act as a booster of human immune systems, followed by an important study in 2022 highlighting tea’s high content of a class of key bio-actives, flavan-3-ols.

Consumers clearly discovered their own personal “tea ceremonies” during COVID, whether using a family recipe or a “mom’s” kettle or a certain mug, and continue to embrace these “for myself” moments as a way to cope with the stress of the work day. And we know that the process of making tea, in and of itself, calms and relaxes. This coupled with tea’s natural ability to induce a “relaxed but ready” mental state, heightens the feeling of serenity and internal quiet – mental states that were at a premium during this past year.

Literally thousands of published scientific journals continue to document tea’s ability to positively impact human health. Whether potentially interfering with cancer mechanisms, enhancing heart health, slowing neurological decline, positively impacting weight management and preventing diabetes, or improving bone health and lastly boosting immune functionality, tea is good for you and tastes great!

Inventory imbalances continued in 2022. The Federal Maritime Commission (FMC) and Biden administration did step in and helped to defuse the unconscionable levels to which ocean freight companies raised their rates. As a reminder, some export regions, particularly Asia, saw the cost of a FEU (40 foot equivalent unit) going from US$3,000 to US$17,000. The Tea Association of the U.S.A.’s participation in a Freight Coalition consortium assisted us in helping to apply pressure and provide notice to key players in the government and maritime bureaucracies to act on consumers behalf.

Tariffs on tea from China continued as a holdover from President Trump’s administration and continued under President Biden. We continue to advocate for removal of this tariff on Chinese tea, although to date, there seems to be no interest in removing them by this Administration.

Our work in Washington D.C. continued with the Tea Association communicating its positions on behalf of the industry in the areas of tariffs, labeling (country of origin and nutritional), dietary guidelines, healthy definition for tea and port congestion issues. Support and defense of the tea industry continues to be our primary our mission.

In all efforts, the Tea Association of the U.S.A. attempts to ensure cohesive messaging across borders by liaising with the Tea & Herbal Association of Canada and the UK Tea & Infusions Association. Of late, this includes addressing such topics as heavy metals; HTIS classifications and modifications; Prop 65 actions; sustainability issues and nano-plastics in tea bags. Sustainability continues to be an important driver for consumers, customers and industry supply chains.

Foodservice Improves; Specialty Tea Continues Growth; RTD Is Recovering Its Shares; Traditional/Grocery Works to Hold on to Previous Gains

We all know how devastated the foodservice market was during COVID. Thankfully, stay-at-home orders, prohibition of indoor dining and social distancing requirements that kept people far away from their favorite restaurants, deli’s and convenience stores are generally no longer. Fortunately, this sector began to come back in 2021 as vaccination rates increased, domestic travel resumed and federal and state governments eased restrictions, and continued in 2022.

As one key foodservice operator reported…

“We witnessed the food service bouncing back post-COVID, despite the huge increases in sea freight. As you are aware, the unprecedented freight costs that we witnessed in the past from origins such as China, Vietnam, Argentina, who are the main supply sources for the food service iced tea, did not in any way dampen the appetite for iced tea consumption.

“Our customers were willing to pay these costs and keep their customers happy. For example the sea freight from China to Long Beach/L.A. was approximately US$2,000 prior to COVID. This peaked to US$ 20,000 per FCL last season. From paying a mere 10 USC /kg we ended up paying a dollar on a kilo for low priced teas. The demand was further driven by relatively lean inventories with packers and end customers.

“Overall, we saw demand ultimately approaching levels not seen since the outbreak of COVID. Furthermore, food service restaurants that served quality food products (we saw long lineups at these outlets), where premium quality tea was served, gained market share. A most welcome outcome from our perspective compared to others, who are driving prices down and compromising on quality.”

Fortunately, some segments of the market won’t change its upward trajectories! Specialty tea continues its rise in both pounds and dollars. Led by Millennials and Gen Zs, consumers across all demographics continued to consume tea for its variety of origins, types and flavors. Tea generates interest in terroirs, flavors, origins, bush to brand and sustainability, particularly in these high quality, higher priced teas. Artisanal teas remain of high interest and continue to grow at a fast clip. Consumers are becoming more engaged with their teas and want to learn more and more about where their teas come from; how they are harvested and manufactured; how the product supports the livelihoods of those making it; and, how friendly the product is to the environment. Specialty tea buyers, in particular, seek to engage with their products of choice.

Ready-to-drink (RTD) tea category continued its dollar growth, but volume was a challenge in 2022. Estimates are that 2022 exhibited circa seven to eight percent growth in dollars, but a decline of some and less than one percent gallonage. Challenges for RTD remain clear: Competition across other categories, e.g., health, refreshment and hydration, will challenge this category’s ability to innovate and compete in order to continue volume and dollar growth. We continue to see separation and segmentation between premium, high quality RTDs and the value, carbonated soft drink (CSD) replacement segment. Innovation, flavor variety and healthful positioning will continue to be legs of growth.

Traditional tea (grocery/DMM [Drug/Mass Merchandisers]) fought hard to maintain the gains from 2020 and 2021. Communication to consumers through traditional media and social media was at a much higher level than previous years, and that speaks to the improved bottom lines and need for re-investment in brands.

As an industry, we are challenged to continue educating the consumer in the difference between true teas (Camellia sinensis) from herbals and other botanicals, neither of which have the same level of AOX or overall healthful qualities. Our messaging across all forms of tea through our social media initiatives highlight the benefits of “true tea” and should be amplified by all tea companies.

Internationally, producer countries of origin continue to protect and advertise their teas through geographic designations and by trademarking their unique terroirs. The adoption of wine-like appellation marketing and protection serves to differentiate one region from another as well as proactively communicating to the consumer the benefits of geography, elevation and climate as key ingredients to tea quality.

Market Growth

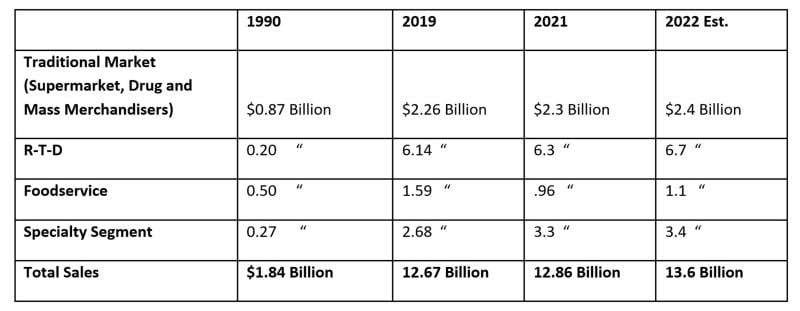

Each year, we try to estimate the size and growth of the various tea markets. We derive many of these estimates qualitatively with some quantitative validation. Further, we note that the consumer price index (CPI) for food inflation in 2022 was 9.9 percent and an incredible challenge for U.S. consumers. Please use these figures as a guide.

2023 PREDICTIONS

Tea will continue to grow across all sectors, led by specialty and foodservice.Whole leaf teas/specialty tea will continue its penetration with consumers in this segment. Individual terroirs and countries will continue to attract interest.

The “Power of Tea” Continues to Shine

- Cardiovascular health, immune boosting properties and improvement of mood are the most popular reasons as to why people drink tea according to a qualitative survey by Seton Hall University.

- Black tea continues to emerge from under the shadow of green tea’s health aura with ownable health properties – cardiovascular health, physical health, immune system boost, bio-active compound, satisfy thirst/hunger, pick-me-up.

- Green tea continues to drive consumer interest, specifically: emotional/mental health, immune system boost, consume when feeling ill, stress relief.

- Foodservice will continue its return to pre-pandemic levels.

- Consumers will continue to enjoy tea and the new levels of tea consumption will be maintained, helping Grocery/DMM sales to resist declines vs. pandemic gains.

- RTD will continue to grow.

- Specialty continues its growth in both dollars and volumes, as unique offerings from tea growing “appellations” become more widely known.

THE TEA MARKET WILL CONTINUE TO FACE THE FOLLOWING CHALLENGES IN 2023:

1. Sustainability

The Tea Association of the U.S.A., sees sustainability as a three-pronged strategy – ecological sustainability, social sustainability and economic sustainability.

The tea industry has demonstrated a strong commitment to ecological sustainability and continues on its journey for a sustainable supply chain.

Concurrently, our industry has successfully embarked on a path of making our product even more sustainable. I venture to say that tea is one of the most ecologically sustainable agricultural products in the world. However, this path comes with its own toll, and the sad fact is that the cost of sustainability efforts almost always fall on the shoulders of the producer, the segment that can least afford it. Further, the promise of increased margins and consumers willing to spend more money on sustainably sourced products have been empty, at best. And all our efforts may be blunted by climate change.

Economic sustainability continues to be a challenge. Producers and smallholders are generally not making money. The realized prices of tea have not moved since the 1950s, when taking inflation into account. This marginalizes workers at origin and drives the industry to an unsustainable economic model, impacting the ability for tea workers to maintain the social fabric in the towns and villages where they live. Meanwhile, large retailers advertise and speak about sustainability, yet do nothing about allowing the price of the product in their stores to rise, disallowing the opportunity for the producers to realize a reasonable margin. The time is come to put pressure on retailers to ensure that EVERY player in the supply chain receives fair value for the work they do.

It is a cultural imperative that parents want a better life for their children, and what underpins the ability to make that happen is for there to be steady and fair wage growth for the family to thrive. However, throughout the tea industry we’ve seen a flight from tea estates to the cities by the most recent generations. Clearly, lack of job growth and the ability to provide a better life are driving reasons. Having said that, I continue to believe that the biggest contributor to this migration is the cellphone. This device provides virtually anyone in the world access to the globe. Whether learning a language, discovering different cultures and lifestyles or, more importantly, being able to imagine greater potential for oneself, the mobile provides a window on alternatives to current realities.

This migration from rural to urban highlights another consequence of low prices… the lack of available labor. We’ve already seen the results of this in Japan, where the average age of tea producing villages has gone from the mid-50s to the low 70s. And 80 percent of towns and villages have lost people. Analogous movements are being witnessed in virtually all traditional tea growing areas.

2. Supply and Demand

The global picture is not pretty, as production went from 4,299 million kgs in 2011 to 6,455 M kgs in 2021 an increase of approximately 50 percent. Meanwhile, population in 2011 was seven billion. In 2021 it is estimated to be 7.9 billion, only a 12.8 percent increase (statistics courtesy of the International Tea Committee). Supply continues to outstrip demand and history has proven that if tea prices rise, the producers will manufacture more tea to take advantage of the higher prices. Certain origins continue to expand tea plantings, completely ignoring the impact on tea surplus. Further, producers, by skipping pruning cycles or plucking a little further down on the bush, have an almost immediate ability to turn on a volume tap of 20 percent more tea. The result of higher availability and poorer quality: lower prices. Escaping the clutches of this boom/bust cycle will be one of the keys to the long-term survival of the business. There are only two solutions: drive consumption or reduce production. Note that these solutions are not exclusive and should be done in tandem.

The unremunerative pricing of tea undercuts all sustainability efforts and creates an unsustainable future for the industry.

3. Free and Unencumbered Trade

International trade is becoming much more of a challenge to the entire supply chain. We have all seen the impact of the global shipping supply chain, the piling up of containers at the ports, increased freight rates, lack of trucks and truck drivers and poorly positioned empty containers at origin. We have also seen ocean carriers and ports use this disruption to their favor and increase costs to an almost unconscionable level.

Further, we continue to see barriers to trade through: lack of harmonization of crop chemical tolerances; political vs. science-based regulatory decisions (e.g., glyphosate); country of origin labeling; and tariffs.

Free trade is a basic building block that we must have in order to fully return to economic growth and stability. Our industry must work together to properly address these issues.

4. The Goodness of Tea

The number of positive attributes regarding tea continues to be buttressed by research and demonstrates why this great product should be consumed by EVERYONE! More research continues to be published highlighting the power of tea.

The U.S. dietary guidelines are due for updating and the Tea Association of the U.S.A. will be submitting comments in an effort to include tea in this important government publication and recommendation.

WHAT THE INDUSTRY NEEDS TO DO

So, where are we? Too much tea being produced; prices too low; we are leaders in ecological sustainability, but social and economic legs are struggling; retailers continue to push down pricing; costs are being pushed up the supply chain.

This is not about painting an ugly picture. It is about realistic assessment of our challenges, which can then help frame our actions to mitigate the problems.

As an industry, we need to continue to meet in multiple forums to discuss honestly and openly our excess supply. The Food and Agriculture Organization, tea associations, tea boards, tea producers and governments need to collaborate and create pathways for crop/surplus reduction, while striving to protect the lifeblood of tea producers, and, in particular, smallholders.

Efforts must continue to drive tea consumption. Tea and Health is THE platform from which powerful messaging can be developed to incent and motivate consumers to drink tea. In April of 2022, the USTA hosted the 6th International Scientific Symposium on Tea & Human Health. This virtual meeting highlighted the power of tea, and most importantly, the outputs of that meeting have driven consumer engagement to the tune of more than five billion impressions through both conventional and social media. If we all help to drive this message, think of the potential influence we could have on driving tea consumption! Additionally, bio-actives research points to more positives in tea’s positive impact on human health.

Costs of sustainability efforts must be shared throughout the supply chain, not borne just by producers. Is there a mechanism currently? No… but this has to be addressed. If consumers want sustainable products, they must pay. If retailers want to sell sustainable products, they need adjust their margins. If packers want to pack sustainable products, they must pay OR they must support sustainability programs through pricing mechanisms.

Leverage existing associations and councils as representatives and speakers for the industry. I continue to be shocked at how easily some companies withdraw from associations based solely on cost, yet, it is these very groups that most effectively represent the industry and protect brands; interpret governmental regulations and provide a single point of contact for both internal and external communication. My thanks go to Tea & Herbal Association of Canada and UK Tea & Infusions Association, who work tirelessly with us on joint efforts to represent the industry.

I remain firmly optimistic going forward. Tea has so much to offer to its consumers. Tea’s supply chain is resilient; producers generally want to produce good product and consumers want to receive good value.

Peter F. Goggi is president of the Tea Association of the U.S.A, Inc., Tea Council of the USA and Specialty Tea Institute. Goggi began his career at Unilever and spent more than 30 years working with Lipton Tea as part of Royal Estates Tea Co. He was the first American-born tea taster in the history of T.J. Lipton/Unilever and was featured on The History Channel’s Modern Marvels. His career at Unilever included research, planning, manufacturing and procurement, and his final position was director of commodities procurement, sourcing over $1.3 billion of raw materials for all operating companies in the Americas. At the Tea Association, goggi has implemented and updated their strategic plans; has continued to drive the tea and health message of the Tea Council; and helped to guide the tea industry on its path to growth. Goggi also serves as the U.S. representative on FAO’s International Governmental Group for Tea, and he continues to drive communication and understanding of the multiple issues faced by the tea industry – locally, regionally and internationally.

Founded in 1899, the Tea Association of the USA, Inc. was formed to promote and protect the interests of the tea trade in the United States and is the recognized independent authority on Tea. To learn more, visit TeaUSA.org.

Plan to Attend or Participate in the

World Tea Conference + Expo, March 27-29, 2023

To learn about other key developments, trends, issues, hot topics and products within the global tea community, plan to attend the World Tea Conference + Expo, March 27-29, 2023 in Las Vegas, co-located with Bar & Restaurant Expo. Visit WorldTeaExpo.com.

To book your sponsorship or exhibit space at the World Tea Conference + Expo, or to enquire about advertising and sponsorship opportunities at World Tea News, contact:

Ellainy Karaboitis-Christopoulos

Business Development Manager, Questex

Phone: +1-212-895-8493

Email: [email protected]

Also, be sure to stay connected with the World Tea Conference + Expo on social media for details and insights about the event. Follow us on Twitter, Facebook, Instagram and LinkedIn.