At the time of writing this, the Sri Lankan tea crop is some 20 percent behind last year and prices are 20 percent ahead of where they would normally reside, given its relative realization against other origins and overall global crops. However, these are abnormal times in Sri Lanka, driven by conditions that span back a few years or, some would argue, a few decades.

Much has been reported in the mainstream global press about the reasons for Sri Lanka’s economic collapse, and forgive me for being repetitive, but these issues need to be stated again if one is to come up with meaningful lessons for the future of tea in Sri Lanka and in other origins, too.

The Foreign Reserve Deficit

Sri Lanka’s issues stem from its foreign reserve deficit, resulting from factors as disparate as they are intertwined. From terrorist bombings, COVID-19 and the cry of “Debt trap diplomacy,” there have been many externalized reasons for the current issues – some valid and some spurious – but there has been one constant and that has been the Rajapaksa dynastic rule over Sri Lanka with absolute power.

One could argue that recent external events are only catalysts for magnifying the very tenuous grasp that the Sri Lankan administration had for fiscal responsibility – either through gross incompetence and/or something much more sinister. Only time will tell.

Other excusable or unavoidable issues were added to the mix in Sri Lanka, in addition to many mismanaged and mistimed political decisions (including unnecessary tax cuts), which all started to describe a downward spiral from which little could be done.

The story’s end was never in doubt for this island’s economy, but things could have been so much better if tea had been treated as its export earnings potential deserve.

Throughout the last miserable two years, tea has continued to contribute approximately $1.2 billion a year in Sri Lanka, which makes a recent decision by the government to ban the very nitrogenous inputs (fertilizer) that are required to make lots of high quality tea unconscionable. This one blinkered act, an attempt to stop the drain of hard currency on imports of fertilizer and other agro-chemicals, thinly veiled as “the right thing to do,” saw tea, rice and vegetable yields drop dramatically.

Now, the urgent importation of foodstuffs to make up the nutritional deficit has, ironically, accelerated the hard currency drain it purported to stop, and created serious mid to long term risk for the nation and it’s tea industry.

A Cocktail of Issues and the Impact on Tea

The hiatus in fertilizer supplies saw crops decimated by 20+ percent in Sri Lanka, and quality determined by nitrogen values was reduced. At the same time, access to fuel and energy has been curtailed, hampering everything from field collection and production schedules to the movement of tea from factory to the Port of Colombo in Sri Lanka for sale and export. Cumulatively, auction offerings have been down by 25 percent thus far, which has had a profound effect at auction with prices sharply up in Rupee terms, but relatively stable in dollars, due to devaluation.

See a graph of Sri Lanka’s tea average in Sri Lankan rupees and dollars from the Tea Exporters Association Sri Lanka here.

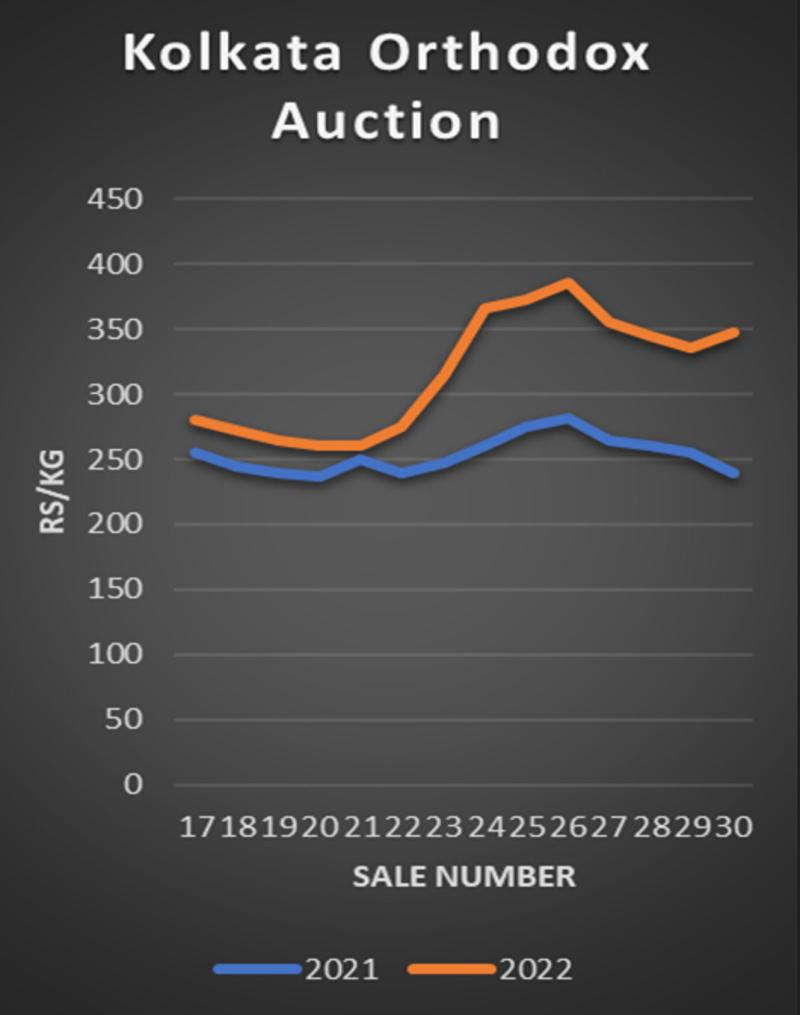

The overall potential damage to Sri Lanka’s tea industry has forced buyers to look elsewhere, to remove risk from their businesses and move away from problem areas, despite a preference for Ceylon tea. This is evident in the stable dollar pricing and the uplift in orthodox markets elsewhere.

Even when the economy is back on an even keel, what then for tea buyers, who will then be accustomed to other origin teas with, invariably, a lower cost of production? Faced with global inflation and interest rate hikes, it is not going to be an easy about turn for Sri Lanka.

Is It All Doom and Gloom?

No, it’s definitely not all doom and gloom.

One has to remember that Sri Lanka exports 50 percent of its tea in value-added form, and while devaluation means that certain material inputs (packaging material, flavors, etc.) will be higher, the value addition to Ceylon tea will more than compensate adding measurably to the competitiveness and sustenance of the industry.

New initiatives from the Sri Lanka Tea Board, including a geographical indication initiative and a new marketing drive to reinstate the obvious merits and importance of Ceylon tea to the global community, though some in the industry could be skeptical about the impact of either, given all the challenges.

Key Takeaways

What lessons can the tea industry take from this very unfortunate period for Sri Lankans and their tea industry?

A Strong Working Public/Private Sector Partnership in Sri Lanka – The institutions in Sri Lanka may be in place for a strong working relationship between the public and private sectors, but, obviously, the very loud warnings from the tea sector with respect to initial proposed ban on agro-chemicals were not heeded. Thus, governments in tea-growing regions need to let vital sectors, like tea growers, use their knowledge to develop critical strategies that will benefit the health and growth of that industry – all with the support of government leadership.

The Need for Supporting the Tea Industry with Contextualized Data – In looking at the case of Sri Lanka and its challenges, an analysis of the size of the global market for organic tea, the competitiveness within this sector, and the impact of agro-chemical move on COP (cost of production) would have enlightened the government and possibly prevented the ban on fertilizers.

Many tea origin countries and regions have and are making decisions based on irrelevant data sets that do not present enough context for strategic planning.

Vertical Integration Is Key – Vertical market integration for tea can be a protective strategy as well as one that increases share of the margin pool. Value added product sales extends the brand equity of the origin (the Ceylon tea brand for Sri Lanka) and health further down the supply chain, enabling strong relationships based on GTM (go to market) strategies at higher price points than that of the commodity itself.

Despite severe difficulties experienced by Sri Lanka during the crisis, their branding opportunities are unique and not easily usurped or mimicked by other origins.

Final Thoughts

There is no real conclusion to this story, as the situation in Sri Lanka is ongoing and will remain very tough for the country in the months ahead (or years). However, other origins take note: There are lessons to be learned – many of which are still to be uncovered.

As absolute lovers of Sri Lankan teas, the people and the island of Sri Lanka, everyone in the global tea industry certainly wishes their recovery to be speedy – as we all need Ceylon tea in our day.

John Snell, NMTeaB Consultancy, has spent 40 years in the tea industry, working with everyone from global brand leaders to traders and private label packers, in management of procurement, development and sustainability. His day job is now consulting for those that “do not want to spend 35 years trying,” in his words, and work ranges from product development and GTM strategies to international development projects. Snell has spent the last 27 years in North America, where he has been an active member of the trade, sitting on the board of the Tea Association of the USA and as a regular speaker at North American Tea Conferences. He sits on the Canadian Tea Association’s grading panel and is a regular contributor to World Tea News. If you ask him what “floats his boat” (a relevant analogy given his earlier days in the Royal Navy), it is always about empowering others to arrive at responsibly derived beverage solutions that deliver outstanding results for the companies he works for. He is clear that sustainably sourced and produced products are more profitable. To learn more, visit nmteab.com.

Plan to Attend or Participate in the

World Tea Conference + Expo, March 27-29, 2023

To learn about other key developments, trends, issues, hot topics and products within the global tea community, plan to attend the World Tea Conference + Expo, March 27-29, 2023 in Las Vegas, co-located with Bar & Restaurant Expo. Visit WorldTeaExpo.com.

To book your sponsorship or exhibit space at the World Tea Conference + Expo, or to enquire about advertising and sponsorship opportunities at World Tea News, contact:

Ellainy Karaboitis-Christopoulos

Business Development Manager, Questex

Phone: +1-212-895-8493

Email: [email protected]

Also, be sure to stay connected with the World Tea Conference + Expo on social media for details and insights about the event. Follow us on Twitter, Facebook, Instagram and LinkedIn.