Consumers are turning to Amazon to look for their favorite teas, as Amazon search volumes for a number of tea-related keywords are on the rise.

These are just a few of the trending keywords showing a strong month-over-month search volume increase:

- Apple Cider Tea up 94 percent

- Elderflower Tea up 43 percent

- Iced Tea Bags up 36 percent

- English Breakfast Teabags up 30 percent

- Sweet Hibiscus Tea up 28 percent

DATA & TEA TRENDS BREWING AT AMAZON

Whether consumers drink their tea iced or hot, our study of the tea market shows several trends brewing – and offers some insight into how brands can tap into this burgeoning market.

Tea Trend No. 1: Superfood Tea

Consumers are looking to tea for a nutrient-packed pick-me-up. Revenue for superfood tea has surged by 27 percent, while unit sales for the category soared by 33 percent January-April compared to September-December. Revenue for this box of superfood tea from Miracle Tree jumped by 100 percent between March and April.

Tea Trend No. 2: Immunity Tea

Sales of immunity tea are on the rise as consumers look to boost their immune systems. Revenue for the immunity tea category on Amazon has risen by 19 percent, while unit sales have increased by 13 percent over the last four months. In fact, revenue for this package of Go Natural pine needle tea, which is said to be high in antioxidants, is up by 293 percent over the last 30 days.

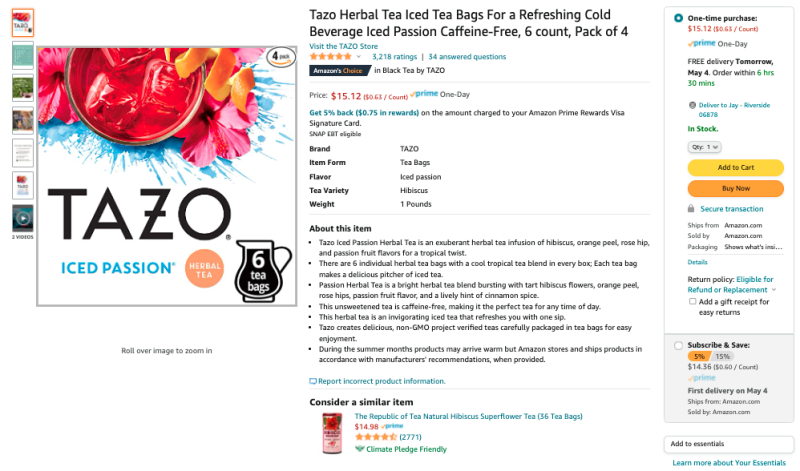

Tea Trend No. 3: Iced Tea

Consumers are buying tea for iced beverages as the thermostat rises. Revenue for the iced tea bags category on Amazon has climbed by eight percent, while unit sales have increased by 16 percent since January (By contrast, revenue for the black tea category dropped by 20 percent and revenue for the green tea category fell by eight percent over that time.) Take this pack of TAZO iced tea bags, whose revenue has risen by 3,196 percent between March and April.

Tea Trend 4: Ginger Root Tea

Ginger root tea is popular with consumers on Amazon, too. Revenue for the ginger root tea category on Amazon has increased by five percent, while unit sales have risen by eight percent in the first four months of the year. Revenues for this package of ginger root tea by Eat Well Premium Foods were up four percent over a one-month period.

Tea Trend No. 5: Major Tea Brands

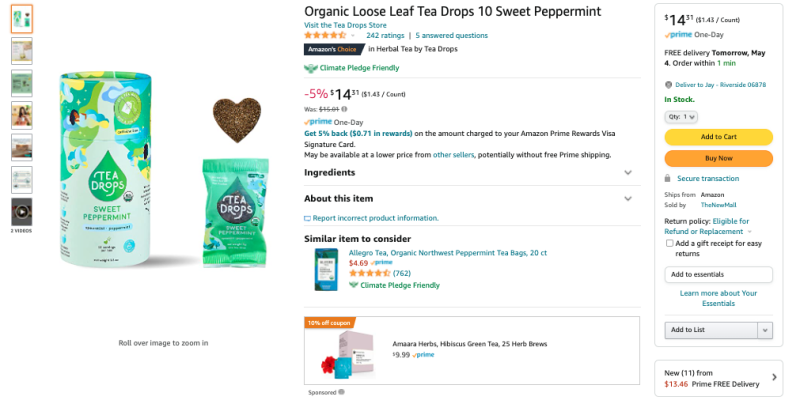

Sales of tea from major brands such as China Mist and Lipton are on the rise. However, sales of tea from other major brands like Tea Drops and The Republic of Tea fell overall, although each brand had products in their Amazon catalogs that experienced revenue increases.

In particular, China Mist saw a stunning 157 percent increase in revenue since January. For example, this box of China Mist chai tea, which is Climate Pledge Friendly and biodegradable, saw a 11,160 percent jump in revenue over one month, potentially as consumers look for more eco-friendly products.

Iconic tea brand Lipton saw a modest three percent rise in revenue over the first four months of 2022 compared to the last four months of 2021, which is notable as Lipton is a traditional hot tea brand that is seeing a rise in sales even with warmer weather. This pack of Lipton herbal tea bags – “a comforting herbal tea blend to help you unwind,” saw a five percent climb in revenue over the last month as consumers look to a comforting tea beverage to relax.

The Tea Drops brand, which makes organic, bagless, whole leaf teas, saw its revenue fall by 39 percent and unit sales drop by 30 percent between January and April. Tea Drops only has one listing with “iced tea” in the search results for its brand name, a factor that could have led to the decrease in sales. By contrast, China Mist features several listings with “iced tea” in the title and product imagery that features tea on ice.

However, revenue for Tea Drop’s Sweet Peppermint Tea Drops are up 913 percent in the last 30 days, potentially helped by the Amazon’s Choice in Herbal Tea label on its listing.

Revenue for The Republic of Tea, which is the purveyor of over 300 all-natural premium teas, herbs, and gifts, fell by 18 percent, while unit sales similarly declined by 17 percent during the last four months. Similar to Tea Drops, The Republic of Tea listings do not feature iced tea in the title or imagery. However, sales of their Wild Blueberry tea refills soared by 3,206 percent between March and April (blueberry is more of a warm-weather flavor, after all).

FOUR BEST PRACTICES FOR SELLING TEA ON AMAZON

Tea brands can take a number of steps to make their products stand out from competitors, increase their Best Sellers Rank, and drive sales on Amazon. Keep reading for Jungle Scout’s four best practices for optimizing your tea brand on Amazon.

1. Optimize Your Product Listings

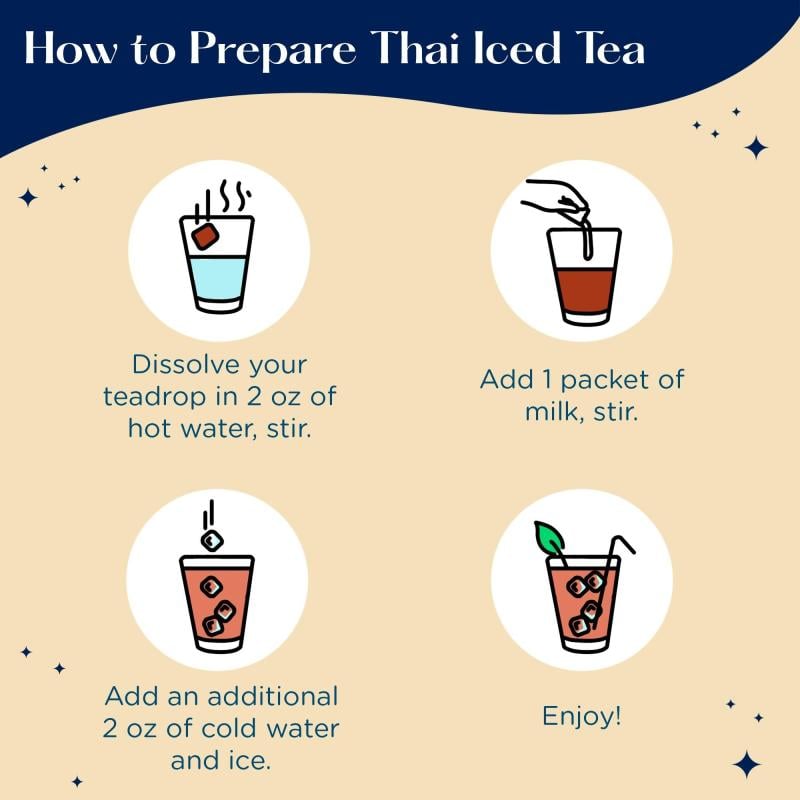

With the arrival of higher temperatures, consumers are looking for cold instead of hot beverages. Be sure to note in your listings that your tea can be made into an iced beverage: some consumers might not know how to make iced tea with hot tea bags or leaves.You can use infographics to provide “how-to” instructions. For example, Tea Drops employed this strategy for their Thai Iced Tea:

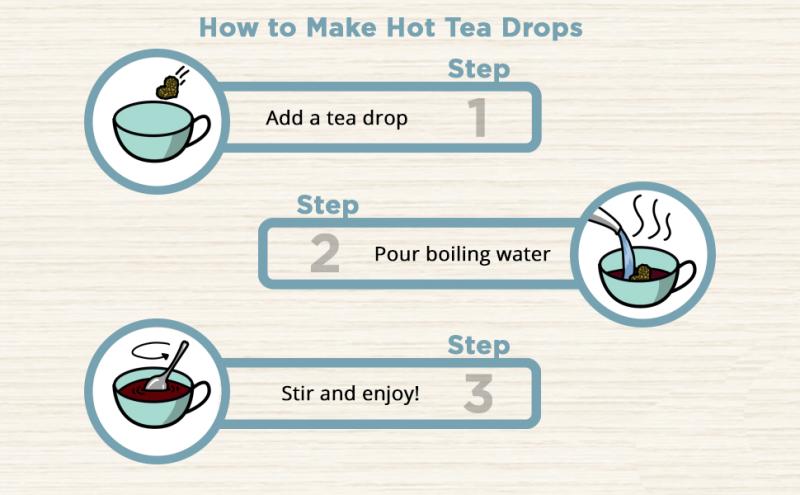

Tea Drops also provides customers with how to make tea drops for hot tea for the colder months of the year. For example, the brand provides these instructions with their peppermint tea drops:

2. Use Keywords That Drive Sales

Research top and trending keywords with a tool such as Jungle Scout’s Keyword Scout. Include these keywords in your ads, front-end copy and back-end copy. Keep in mind that consumers might use less common terms to search for similar products (i.e. “ice tea” instead of “iced tea”).

Here are some examples of monthly search volumes for iced tea-related keywords:

- Iced Tea Bags, up 172 percent

- Bottled Iced Tea, up 63 percent

- Iced Tea Bags, up 36 percent

- Peach Iced Tea, up 29 percent

- Cold Infused Tea, up 28 percent

Note: Keyword research never ends. As tea is a highly seasonal product, you should update your keyword strategy as the seasons change.

3. Increase Your Number of Customer Reviews

Reviews provide valuable social proof that gives customers the confidence to hit the buy button. Sign up for Amazon Vine if you have Amazon brand-registered products and fewer than 30 reviews. This program helps newly registered products get reviews fast.

You can also use tools like Jungle Scout’s Review Automation to get more product reviews and increase sales. This tool automatically sends out review requests to all eligible orders, eliminating the time-consuming task of manually requesting reviews on Seller Central.

You can also include inserts in your product packaging but be sure to remain neutral when writing your content: You can’t ask customers to leave you a five-star review or even show a picture of five stars. But you can give useful information about your brand and product.

4. Set an Omnichannel Strategy

As consumers turn to a wider range of channels to find what they are looking for, it is essential to have your products available on Amazon, on other ecommerce websites, and in brick-and-mortar stores. Consider that consumers might have different shopping preferences – some may prefer to shop online, while others might like to shop in stores.

5. Expand Your Product Catalog on Amazon

You can also consider selling a variation on a product that you already offer for sale on Amazon. For example, if your brand sells black tea, you could consider selling green tea or oolong tea. And, if your product catalog doesn’t include iced tea for warmer weather, consider purchasing bulk branded products from an iced tea manufacturer to sell on Amazon. Then you can continue to make Amazon sales during your off-season when hot tea isn’t as popular.

By offering more products on Amazon, you can better serve existing customers or attract new customers. You can also use this strategy to grow your market share on Amazon and increase your brand’s presence on the platform. With more products in your brand’s Amazon catalog, you have more chances to generate sales and take a larger share of revenue in your category.

Increase Your Chances for Success by Following the Data & Trends

In the end, the tea business sector is highly competitive, but brands can increase their chances for success by offering in-demand products and setting an effective Amazon strategy. By following the latest trends in tea, along with the best practices for selling in this category on Amazon, you can position your brand to win on Amazon – and beyond.

The product data in this report is representative of the U.S. Amazon market. Market insights on Amazon products were sourced from Jungle Scout Cobalt, an industry-leading market intelligence and product insights platform powered by more than 1.8 billion Amazon data points every day. Revenue increases for categories are comparisons of the period of Jan. 1, 2022 to April 30, 2022 and Sept. 3, 2021 to Dec. 31, 2021. Revenue increases for products are comparisons of the period of April 3, 2022 to May 3, 2022 and March 5, 2022 to April 2, 2022.

Jay Polansky is the enterprise content writer at Jungle Scout. Jungle Scout is the leading all-in-one platform for selling on Amazon and beyond. Founded in 2015 as the first Amazon product research tool, Jungle Scout today features a full suite of best-in-class business management solutions and powerful market intelligence resources to help brands, agencies and investors manage their ecommerce businesses. To learn more about Jungle Scout, visit JungleScout.com.

Plan to Attend or Participate in the

World Tea Conference + Expo, March 27-29, 2023

To learn about other key developments, trends, issues, hot topics and products within the global tea community, plan to attend the World Tea Conference + Expo, March 27-29, 2023 in Las Vegas, co-located with Bar & Restaurant Expo. Visit WorldTeaExpo.com.

To book your sponsorship or exhibit space at the World Tea Conference + Expo, or to enquire about advertising and sponsorship opportunities at World Tea News, contact:

Ellainy Karaboitis-Christopoulos

Business Development Manager, Questex

Phone: +1-212-895-8493

Email: [email protected]

Also, be sure to stay connected with the World Tea Conference + Expo on social media for details and insights about the event. Follow us on Twitter, Facebook, Instagram and LinkedIn.