SHIZUOKA, Japan

A year after the catastrophic Tohoku Quake, Japan’s tea industry has restored its production capability and is “cautiously optimistic” that a bountiful tea harvest this month will be warmly received.

Imports of Japanese tea, mainly greens, grew by almost 2 percent in 2011 despite unprecedented setbacks. The declared value of Japan tea imports has soared 30 percent.

Retailers that specialize in the teas of Japan have “rediscovered” to their customer’s delight many regional varieties grown in the southern islands.

Strict food safety precautions, including a tough new standard for the presence of radioactive isotopes, are now in place and private testing is rigorous following reports last spring of contaminated tea.

“The Japanese are a resilient people but the triple disaster that struck just over a year ago was more than anyone person or society should have to endure,” said Joe Simrany, president of the Tea Association of the USA. Japan is a “vivid example for the rest of the world as to what is possible under the very worst of conditions.”

Retail Reaction

Many customers in North America and Europe who favor the teas of Japan took the opportunity this past year to venture into teas from Kyushu; such as Chiran, Ei, and Yakushima in Kagoshima; Yame in Fukuoka, and Takachiho in Miyazaki.

“I believe this exposure will continue to increase in 2012 and 2013 and also help to broaden the understanding of the depth of the Japanese tea world,” says Tatsuo Tomeoka, founder of Charaku Fine Japanese Tea, a Seattle tea retailer supplied by a fourth-generation Shizuoka-based merchant.

Green tea imports into the USA were up nearly 2% in 2011 and their black tea imports were up over 3% for the full year, according to Simrany. “This compares to a 1.7% decline in green Tea imports in 2010. On a three-year rolling average basis, ending with 2011, Green tea imports were up 10.67% for this period,” he reports.

The Department of Commerce office of Foreign Agricultural Statistics (FAS) placed a value of $34 million on the 1,500 metric tons of tea imported from Japan between January and December 2011. This is up from the $26.2 million reported by importers in 2010. The significant 30 percent increase in value is on a slight increase in volume. The declared value averaged $22 per kilo reflecting America’s preference for high-priced offerings such as matcha.

The dollar-yen exchange rates did make these teas more expensive to carry in 2011 and 2012 but has become more favorable for U.S. importers. If this continues it will also help the market to rebound.

“Overall, I think we are poised for a much healthier market in the coming year. The challenges of the Tohoku Earthquake certainly dampened demand in 2011, but it also made people think about Japanese tea, for better or for worse,” said Tomeoka.

“Immediately after the quake last March, people were contacting me daily for updates about the situation,” he said. “Previously taken for granted as a product that would always be on the store shelves, Japanese tea became something that people were thinking about and discussing more seriously,” he adds.

Tea lovers began exploring new Japanese tea tastes and new tea growing regions, and pursuing higher quality teas. “This knowledge can only help to further understanding and appreciation of Japanese tea as we approach the new harvest season and the future of o-cha in Japan and abroad,” he said.

Harvest Outlook

If weather were the only concern, early reports show the 2012 harvest, which is soon to get underway, will be normal.

The discovery last spring of contaminated tea led to significant supply chain disruptions but prices have not risen for Japanese teas as might have been expected from decreased supplies in Shizuoka.

Daisuke Kojo with the Japan External Trade Organization’s Chicago office, said Japan’s central and local governments are conducting radiation tests “quite intensively.”

“Samples found over the regulation limits are decreasing,” he said.

The Japanese government will promptly stop distribution of food if radiation levels are found to be over the regulation limits, said Kojo. In addition to public and private testing overseas, in the U.S. the FDA (Food and Drug Administration) is also conducting intensive sample testing and found no samples over the regulation limits, said Kojo. “In cooperation with U.S. FDA, all those who are related to tea industry are making every effort to secure the safety of food to U.S.,” he said.

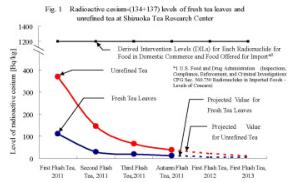

Field tests in Shizuoka showed a decline in radioactive contaminates in unrefined tea from 400 Becquerels per kilo in the 2011 1st Flush to about 150 Bq/kg in the 2nd Flush to just under 100 Bq/kg in the 3rd Flush last fall in Shizuoka. A becquerel is an SI (international standard) unit of measure of exposure to radioactive isotopes. It is the quantity of radioactive decay equal to one nucleus per second.

Contaminate readings in fresh leaves have fallen from 100 Bq/kg last spring into the low double digits. Government projections for the 2012 and 2013 tea harvests are expected well within food safety guidelines. [SEE CHART]

Contaminate readings in fresh leaves have fallen from 100 Bq/kg last spring into the low double digits. Government projections for the 2012 and 2013 tea harvests are expected well within food safety guidelines. [SEE CHART]

Fewer challenges that face Shizuoka in 2012 will contribute to a much healthier tea market for all of Japan, says Tomeoka.

“I'm hopeful that we will have fast, accurate, and transparent data available to us immediately after the shincha harvest. If we do, I think it will do wonders to kick start the market for the coming season. Respect for our customers’ safety concerns is primary for us, and we can only address those concerns with factual and reliable information,” he says.

A detailed report, released in January by the Shizuoka Prefectural Government, tracks the falling rate of contamination at 19 locations in the prefecture and predicts minimal to zero readings for Cesium 134+137 in fresh leaves.

"Projections," however, will not be sufficient for most consumers, either in Japan or abroad,” says Tomeoka. “I heard more negative comments from customers last year about the Japanese Government than about Japanese tea,” he says.

Disasters caused by nature, as devastating as they can be, are usually localized and more easily overcome than disasters caused by man, says Simrany.

“The Fukushima Daiichi nuclear near melt down was felt in every corner of the earth and caused consumers to question the safety of Japanese tea.

“To their credit, the Japanese government met the challenge head-on by monitoring radiation levels on tea and their other important crops and industries to ensure that they did not exceed established limits,” he says. The Tea Association of the USA and Tea Association of Canada facilitated industry discussions and praised the Japans for sharing data with their trading & promotion partners.

“In addition, members of their government and tea industry traveled to important consuming countries and held special events designed to mitigate consumer panic caused by misconceptions and replace it with actual data concerning the safety of their product,” adds Simrany.

“I can sum up my feelings regarding the coming tea harvest in two words, ‘cautiously optimistic,’” says Tomeoka.

Suppliers Respond to Concerns

“We have had an amazing show of support and confidence in teas from Japan,” says Rona Tison, Sr. Vice President-Corporate Relations for ITO EN (North America).

“Our company has put in place stringent quality control measures that our customers appreciate. We have seen increased in quality Japanese teas from Gyokuro to Matcha,” she says.

Fumi Sugita, General Manager of matcha supplier AIYA America, describes steps typical of exporters.

“We source most of our tea from Nishio city Aichi and have done more than 120 radiation tests there since last March,” says Sugita. In addition the company tests the finished tea monthly before exporting to the U.S. The company uses a third-party laboratory in the U.S. “as some of our customers did not believe test report from the Japanese laboratory. “We share these test reports with customers upon request,” says Sugita.

“We are very happy to say that every test confirmed our teas are safe to consume based on both FDA and Japanese regulation,” he says.

In April the Japanese government will change their regulations lowering the permissible levels of Cs-134 + Cs-137 to 100 Becquerels per kilo from the current 500 bq/kg threshold. The FDA enforces a threshold of 1200 Bq/kg. European countries set the limit at 1000 Bq/kg making Japan’s new threshold one of the lowest in the world. The average human body has a becquerel reading of 4400.

“All 120 of our test results meet the new stricter Japanese regulation — proof it is safe to consume,” says Sugita.

Tests are ongoing. “We will keep doing monthly test for our tea and will also do tests after the 2012 crop harvest,” he says.

Shizuoka accounts for the majority of Japan exports. The sencha and matcha gardens and familiar photos of Mt. Fuji are widely recognized globally. Last spring the government shut down several tea factories due to high contaminate readings and ordered growers to cease harvesting in the furthest northern reaches of the prefecture.

“We can't discount the overwhelming importance of Shizuoka Prefecture as not only the major growing region for nearly half the tea in Japan, but the also the place where most of the processing, packaging, and shipping of Japanese tea takes place,” says Tomeoka.

Concern over contamination in the northern prefectures has virtually eliminated the market for the small quantities (400 metric tons) of tea produced in Fukushima and surround prefectures. Japan produces approximately 98,000 metric tons of tea annually, about 2.3 percent of the global supply.

The International Tea Committee tracks imports by country of origin for Japan. Since it is a green tea producer, and tea drinkers there favor greens and oolongs, China is the largest exporter to Japan, supplying 20,500 metric tons through November 2011. Taiwan exported 380 metric tons and Vietnam shipped 359 metric tons through November 2011. Import totals are equal or slightly behind 2010 with total volume at 38,955 metric tons, half of which is black tea from Sri Lanka and India.

Exports were surprisingly resilient given the public outcry and media attention. Japan sent 1,302 metric tons of tea to the U.S. through November 2011 compared to 1,272 during the same period in 2010.

The Japanese are an unusually hardy people and the tea that they produce is similarly unique and not easily sourced from any other tea producing country, says Simrany.

“Given the uniqueness of Japanese tea and the efforts of the government and tea industry officials in Japan to convey the safety of their product, the prospects for a complete recovery are excellent,” he said.

Source: FAS GATS, Shizuoka Prefecture